GET THE RESULTS YOU NEED TO IMPROVE YOUR CREDIT

GET THE RESULTS YOU NEED TO IMPROVE YOUR CREDIT

Restore Your Credit With

The Credit Experts

Your Good Credit Makes a Home Possible

THE PROCESS

01

Free Consultation

We'll give you a free professional consultation and credit analysis to see if you are a good fit for our credit improvement program.

02

Enroll

We have a wide assortment of credit-building tools that add positive credit, while we are taking care of negative and erroneous items on your credit report.

03

See Results

Log in to your personal dashboard that is emailed to you where you can see real-time progress and results every step of the way. Click here to see our Testimonials from clients

OUR SERVICES INCLUDE

- Personalized Credit Repair Options to Fit Your Situation

- Experienced Case Analyst and Case Adviser Who Personally Work With You Through the Entire Process

- Custom Credit Challenges Created For Your Case

- 24/7 Access to Your Case States and Progress

- Credit Tools and Educations

HOW WE CAN HELP YOU

We Help Improve Your Credit Scores

By Removing:

REPOSSESSIONS

This occurs when you fall behind on your vehicle’s monthly payment. It can stay on your report for up to seven years making your financial life very difficult for years. Repo’s are also listed in the public record section of your report.

COLLECTIONS

These happen whenever an account is seriously past due. The creditor decides to sell it to a collection agency and it drastically affects your score. Do not pay any collections as this will actually decrease your score.

LATE PAYMENTS

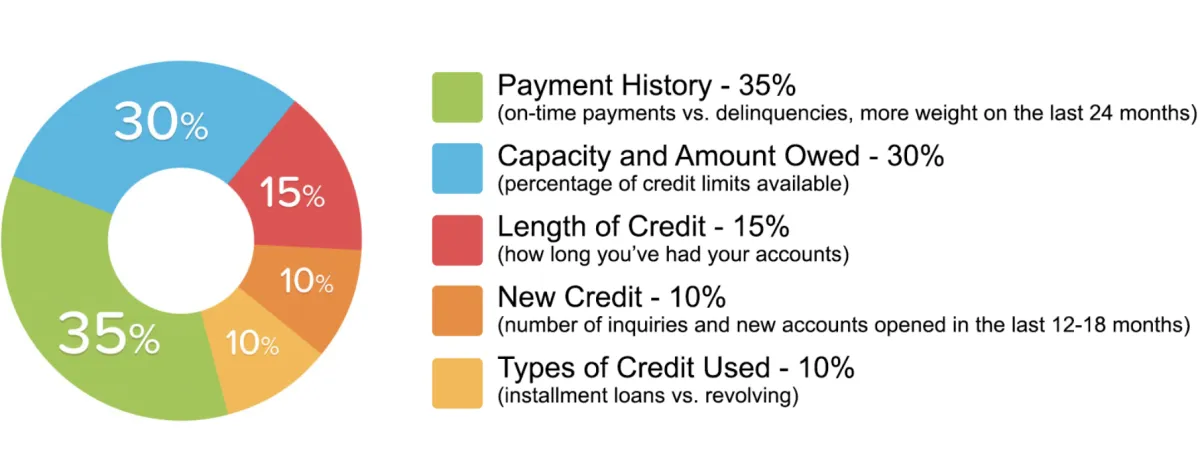

Making your payments late is very unhealthy for your credit score, especially since payment history makes up 35% of your score. So one late payment can make a huge negative impact.

HARD INQUIRIES

Each hard inquiry causes your credit score to decrease. It's important to not run your credit so much since it can be interpreted as an attempt to substantially expand available credit, and create higher risks for lenders.

CHARGE OFFS

When a creditor believes that a debt is unlikely to be collected they will write it off as a loss. This does not mean you are off the hook. You are still responsible for paying the debt back, and it also lowers your score drastically.

STUDENT LOANS AND MORE!

When a creditor believes that a debt is unlikely to be collected they will write it off as a loss. This does not mean you are off the hook. You are still responsible for paying the debt back, and it also lowers your score drastically.

Our Money Back Guarantee

We Have The Best 100%

Money Back Guarantee

120 Day Money Back Guarantee if no score improvement. The guarantee is voided by new negative items being added to the credit report.

IMPROVE YOUR CREDIT SCORE

Searching for a First-Class Credit Restoration Company?